Auto Insurance Tips You Must Read Today

Auto insurance is a must have. The following article will give you narrow down your options so you can get the perfect insurance coverage for you.

You should comb through your insurance options carefully. Every company is different when it comes to how they determine your premium. You will find the policy that is most affordable and best suited to you by checking into policies from several different companies.

You should have a basic knowledge of insurance coverage types before you buy. There are many different situations that come into your final cost of insurance. If you cause an accident that results in the death or bodily injury of another person, bodily injury liability will cover all legal costs and injury claims.

You need to understand the different coverage types offered when you are searching for an auto insurance policy. If you are just getting insurance on one car, there are still many things to consider. In case you hit someone, you can use bodily injury liability to pay for the legal fees.

Make sure to check insurance costs when you are purchasing a car. Insurance agents will be able to research which automobiles have the most economical rates. A car with a higher safety rating means lower cost of your insurance premium.

What kind of vehicle you buy and drive determines a lot about the size of your insurance premiums. Insurance companies charge higher premiums for that high end luxury model you love so much. If you want to save money on insurance, choose a safe, modest vehicle.

When purchasing car insurance for a teenager, be sure to compare the cost of adding your child to the policy you have currently and purchasing a separate policy.

Carpooling or taking public transit can save you money on your auto insurance. One way to secure lower insurance premiums is to use public transportation, so you can put fewer miles on your vehicle. Many providers also offer discounts for commuting.

When purchasing car insurance, remember that only the person named on the policy will be insured unless otherwise specified. Many drivers lend their car out to a friend, the insurance will not pay.You would have to get an addition to your coverage to allow for this.

Do not pay the monthly payments for insurance; do it quarterly. Insurance providers add a convenience fee to monthly payments. The extra money you spend could easily add up. Adding another bill to your monthly pile can also turn into a nuisance. It is much better to have fewer payments.

Do not spread your car insurance bill into monthly payments for insurance; do it quarterly. Your insurance company may add three to five extra dollars to your bill. This small amount has the potential to add up quickly. Adding another payment to your monthly pile can create a nuisance. The fewer payments, the more money you save.

While you are shopping around for car insurance policies, make sure to include property damage liability in your quotes. This can cover any damaged caused by your car during an accident. Every state but three require this. If you are even involved in an accident, property damage liability can protect you from losing a large sum of money.

This strategy carries some risks, but if you want to save money each month and have the willpower to put money away to pay a deductible if you are in an accident, you might come out ahead in the end. Your premiums will go down the higher deductible.

Leave more money in your pocket by choosing a higher deductible. It is a bit risky, but it will help you save on your insurance premiums. You have to make sure to save up money in case you need to pay a higher deductible at some point. The more your deductible is, the lower your premium will be.

Don’t jump right away on the first cheap quote you find. Cheap may say it all or it may be a great deal.

Consider whether your policy provides more coverage than you really need. If your vehicle is older and less valuable and your policy includes collision insurance, it may not be worthwhile to keep paying for it. If you get rid of the insurance, it will save your money. Furthermore, comprehensive and liability coverage are unnecessary for many people, so determine if they are required for your particular situation.

Insurance against drivers who don’t have insurance is also important, as well as non-accident damage to your car like fire or flood, like in a fire.

Even if you may get insurance through a different provider, do not end the policy you current have until you have committed to that other company. Even going a few days without auto insurance is taking quite a large risk because unfortunately, car accidents can occur any time.

Conversely, whenever these things are removed from your record, the lower your insurance costs. Once your record is clean again, it’s wise to do some comparison shopping on auto insurance rates again.

Make sure you check into getting coverage for “uninsured” drivers as a lot of people overlook this part. You will want to consider this option if your budget allows for including this type of coverage. This way, you are protected in the event that an uninsured driver damages your car.

It can be difficult to pinpoint the correct amount of auto insurance you actually require. If you own a lot of expensive things, you should get enough liability insurance to secure them. If you do not have adequate coverage, insufficient liability coverage could drain your assets. Having full coverage will pay off in the price.

Insurance companies are all different. If you are unhappy with the quote you received on your car, be sure to check out several competitors as they all have different prices available.

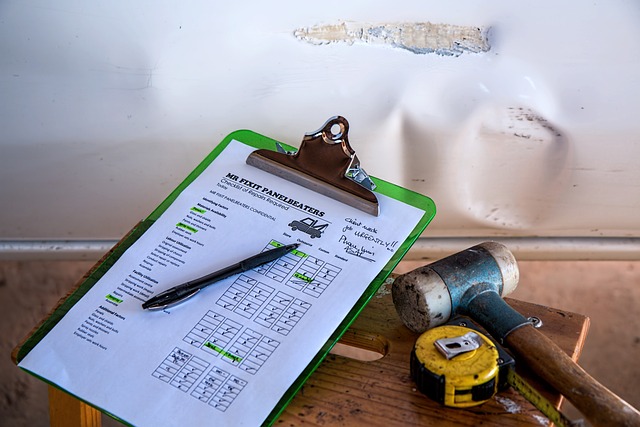

If you are ever in a car accident and need to file a claim, be sure to provide ample documentation. It can be a camera in your vehicle.

When your children move out, you should remove them from the policy immediately. If you remove an extra person your rates will often go down, because the insurance company is taking the risk for one less individual.

100/200/100 level liability coverage is a great thing to include in your auto insurance policy if you have an expensive car.

Many insurance companies provide large discounts to people who do not drive 7500 miles in a single year. If you’re able to cut back on driving by carpooling or using public transportation, your insurance rates just might benefit.

The consumer complaint ratio” that you should be available for most of the car insurers in your state. This number provides what the percentage of claims that are followed with a complaint.

In the unfortunate case of an accident that you have to file an insurance claim for, remember that your insurance company loves documentation. Have a digital camera handy to take pictures in case your get into a car accident. It can be a good idea to always carry a camera with you in the car, just in case.

A 10% discount on your insurance premium is a great benefit.

Think about 100/200/100 coverage if you have a decent vehicle. Your state has set a minimum amount of liability coverage that you must have in order to get a license to drive. Be certain your own car insurance policy meets this minimum level of coverage.

If you want to obtain a low premium on your insurance policy, start by choosing the highest deductible. If you have a high deductible, you are liable for repairs, but you can get protection from total loss or to other’s property.

Inquire if your insurance company has discounts that may reduce your premium. If you drive fewer than 7,500 miles a year, then you may be eligible for a discount. If you take the bus to work, you will have a lower premium. If public transportation isn’t available in your area, try setting up or joining a carpool.

This holds true if you place these features on an old car.

You can get great discounts on putting everyone in your home on your insurance plan. You could save hundreds, even thousands of dollars per year in monthly premiums by insuring all of your vehicles together.

Your premium will also be reduced if you take any public transportation to commute to work. Try carpooling if you cannot use public transportation.

Look over your insurance policy to make sure everything is accurate. You need to know that your policy is right so that you can steer clear of any trouble you may have when you need to file a claim. Is your home address correct? What is the model, make, and year of your vehicle? The amount of miles you place on your vehicle every year has an affect on your premium charges. Therefore, if your commute to work is short, make sure this is noted in your policy.

In most cases, you are eligible for this discount only if your yearly mileage does not exceed 7,500 miles annually in order to secure this type of price break. You may also qualify to receive a commuter discount if you take public transit to work instead of driving.

Be sure that you know the different regulations in the state that you live in when you are talking about auto insurance. All states vary in the amount of minimum coverage they provide. Therefore, it is vital that you know what the requirements are before you buy a policy.

There are many factors that can determine the rates quoted for car insurance. Some of these factors include your marital status, your age and your gender. If you are aware of the factors involved and how they factor into the rate calculations, you will be able to shop for the appropriate price that will suit you.

Once you’ve sold a vehicle, or no longer have it in your possession, be sure to let your insurance carrier know immediately, so that it can be taken out of your policy. Paying for insurance that you do not need is just wasting money.

Insuring several vehicles within the same household can reduce monthly premiums by hundreds or even thousands of money yearly.

If you have a car rental in your insurance policy then think about removing it. The percentage chance of you having to make use of this part of the policy is small compared to the cost you are paying. Though it’s usually best not to include the option, keep in mind that it could come in handy if you ever do need it.

Comb over your policy and make sure that it’s accurate. Accuracy will help if you need to file a claim and saving money. Is your address correct? Is the type of vehicle, model and year all correct?

One little-known way for younger people to get a discount on insurance is getting married. After marrying, couples have reported saving up to 40 percent in savings. If you’ve been considering the next step, you can use it to get you some great discounts.

It is important to have a thorough grasp of your state’s laws regarding car insurance. The minimum insurance coverage necessary can vary widely from one state to the next, so make sure you have this information before you buy what could essentially be a worthless policy.

Buying extra insurance coverage for replacement parts may be senseless. Often, you don’t need this insurance option because mechanics and auto parts manufacturers offer their own guarantees. Do your research to find out if there is any kind of guarantee, before you spend any money on a warranty that isn’t necessary.

One way for younger people to get lower insurance rates is through marriage. Some peopled have reported savings of nearly forty percent on their insurance costs. If you are looking for that extra reason to get hitched to the one you love, walking them down the aisle might walk down your insurance premiums.

You can keep your auto insurance premiums as affordable as possible by exercising caution while driving. You may be able to qualify for safe driving discounts, if you can avoid tickets or accidents for a long period of time. These discounts are valuable, they can save you a lot of money over time, and may potentially increase each year that you remain accident and ticket free. All of these techniques will keep your premiums as low as possible.

Car Insurance

Think about the kind of vehicle you have when considering insurance coverage. Older vehicles that are fully paid for do not require as much insurance, as a new vehicle that is still being paid for. Something else to think about is how often cars like yours are stolen. A commonly stolen car can cost much more to cover for theft.

Do no drive if you do not have car insurance. If you were to get into an accident, car insurance would be the only thing that would keep you from going into a possibly devastating financial situation. These tips should be used to help you along with your search for an insurance company.