Tips That Will Make Your Auto Insurance Venture A Success

Car insurance has purposes other than just your vehicle. It is also a protection to you and every other drivers. You want to feel confident that any insurance policy you obtain will take care of your needs. The following tips will maximize your insurance purchase.

Consider all your options prior to purchasing insurance. Even though insurance companies all have access to the same information in your driving record, they use it differently to decide what to charge as an insurance premium. By checking competitors, you will be able to locate the best deal in which you can save a lot of cash.

If you are thinking of adding a teenager to your auto insurance, shop around for adding them to your existing policy, versus the amount it would cost to get them a separate policy.

When purchasing car accessories, assess the amount that insurance covers in theft or damage. There are lots of cases where the insurance won’t cover these additions.

You can buy additional insurance beyond the legal requirements for your state.You will have more coverage, but it might work out for you in the long run.Uninsured motorist protection is a means to protect yourself from drivers who do not having insurance.

Be sure you to research your potential insurance rate when you are shopping for a car. Your insurance agent can inform you which new cars have the lowest insurance rates. This can help you a lot when thinking about buying a new or used car. You won’t pay as much on car insurance if you buy a car with a solid safety rating.

Think about what type of coverage is needed. There are many options available, but most of them aren’t right for you. If you tend to have accidents, you should include collision coverage in your policy.

Sit down with your car insurance agent to prove that you are correctly covered before personalizing your car. The retail value of aftermarket rims might be $1000, but if they don’t actually add $1000 to your car’s overall value, then it could have negative insurance consequences.

When shopping for car insurance, it is important to keep in mind that they are only insuring the driver of the car that is on the policy. If you let a friend use your car and they get into an accident, your insurance policy has the right to deny making payments if a collision occurs while they are driving. You would have to pay more for insurance so other drivers using your car.

Most states require all drivers to have liability insurance. The law requires you to be pro-active in knowing if you’ve got the required minimum insurance coverage for the state in which you reside. You will break the law and face financial consequences if you have no insurance and get into an accident.

Think twice about spending big bucks for after-market add-ons if you really do not need them.

There is a myth that insurance premiums instantly go down when people turn 25. The truth is that premiums start to decrease when a person reaches the age of 18, assuming that he or she is a safe driver.

Trade in your sports car for something more moderate vehicle.Sports cars generally cost you a lot more in insurance costs. Sports cars are at greater risk of theft, so they cost more to insure.

It is always possible to purchase additional coverage in excess of what the law requires. Making sure you have the right amount of coverage, even if the cost is a little more, is important in the event of an accident. For example, if you get uninsured motorist insurance, you are protected even if the other party involved is illegally driving without insurance.

The best advice when it comes to car insurance is to keep your driving record spotless. A car accident will raise your auto insurance rates quicker than almost anything else. Know your driving limits, and avoid situations that put you in risk of an accident.

Property damage liability is a very important thing to include in your auto insurance policy. This can cover any damaged caused by your car during an accident. Only three states do not require this. It can be a real financial lifesaver if you get into a serious accident with lots of damage.

This strategy carries some risks, but as long as you’re willing to set aside money each month to cover the cost of your deductible in case of an accident, you might come out ahead in the end. A high deductible will pay off in you having a lower premium.

Having appropriate insurance saves a lot of money for someone involved in a serious accident. You will have to pay a deductible and then anything else is covered by insurance.

Think about taking some coverage items off of your auto insurance. If your automobile is not worth much, you probably should drop the collision coverage. You can save a considerable amount of money by eliminating unnecessary coverage. Comprehensive and liability are other things you may want to consider cutting.

Ask your auto insurance agent for a list of discounts offered by his company. Read the discounts options carefully, and mark each that could apply to your situation.

You should not be without auto insurance even for a short time, even if it is only for a few days because auto accidents can happy at any time.

A variety of insurance plans are available so you need to make sure you are adequately covered. Liability coverage protects you if you cause injury or damage to a person or their property, and you will need to be protected in the event of self injury or damage to your own property. In addition, you will need to be covered against uninsured motorists and other potential damages to your cat, for example fire damage.

Insurance companies do not all alike. If you are unhappy with the quote you received on your car, shop around and get others.

Try to bundle your insurance to save money. Search for these types of offers, especially those that bundle auto and homeowners insurance. Make sure to compare the cost of combining your home and auto or insuring them separately before making the decision to bundle.

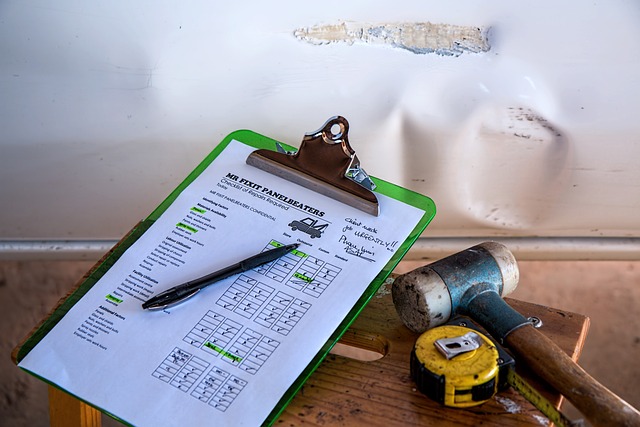

In the unfortunate case of an accident that you have to file an insurance claim for, remember that insurance companies love documentation. It is a good time to leave a camera in your vehicle.

Look over your policy and remove anyone who no longer drives the vehicle. Removing people from your policy has the possibility of saving you money, because the insurance company is going to be covering one less person.

Higher deductibles can have the greatest ability to drastically lower the cost of your insurance costs will be. Remember that you will have to pay a higher amount in case you do get into an accident. You should set up an account to cover this difference in case you need it.

If while comparing insurances you find lower competitive rates, bring the rate to your current agency immediately. Often, they will match the rate to compete.

Getting 10% or more off your insurance is a nice bonus.

A great tip for auto insurance is to get 100/200/100 level coverage for liability if you have a good car with a few assets to protect. You must make certain your insurance policy meets all state minimum requirements for liability coverage.

If you can remove unnecessary drivers, removing them will decrease your premium.

Paying your insurance in one payment saves you money in the long run. Paying in monthly installments can end up costing you more money. Save your money now to pay off your insurance in one go, so that you save money later.

You should always maintain records on your insurance payments. This is great if you ever run into any problems with the insurance provider as you now have physical proof.

By raising your credit score it is possible to obtain cheaper motor vehicle insurance. It is increasingly popular for insurance companies to check your credit scores. Most insurance companies factor in credit scores because studies show that individuals with low credit tend to experience more accidents. With a healthy credit score, you will get cheaper insurance.

You can’t avoid a higher premium entirely if you have a bad record, but some companies are different. There are even a few companies that specialize in insuring those with issues on their records get better rates.

Defensive driving courses offer an easy way to enjoy lowered insurance premiums. Taking these classes can help you become a safer driver. In addition, many auto insurance providers even offer you a discount on your insurance just for enrolling in these programs. You can find these classes at your local driving schools. If you are short on time or there are no classes close to your are, you can try an online version of these courses.

This holds true if you place these features on an old car.

Certainly your premiums will be higher than those of someone with an unblemished record, but each insurance company has its own parameters for determining premiums. If you only have a few negatives on your record, you may be able to find an insurance company which specializes in getting you a better rate.

Your premium may also be reduced if you take any public transportation to commute to work. Try riding with coworkers if you can’t do that.

The higher the deductible, the lower the insurance premium will be. A higher deductible means that you will have to pay for repairs required when minor accidents occur, but you are still protected in the case of a major accident or one in which liability rests on you. Should you be driving a vehicle that has a low value, a higher deductible is almost always the smarter choice.

In most cases, you are going to have to drive less than 7,500 miles annually in order to secure this type of price break. You might also qualify for a commuter discount if you consistantly use public transit to work instead of driving.

If you have a safe driving record, you may be eligible for discounts. By not getting into accidents or acquiring traffic tickets, you may be able to get good-driver discounts. Letting your driving record get sloppy costs money. The more care you take while driving, the better discounts you will get on your insurance policy.

Using the tips and information that you learned from this article, and have another look at your policy. You might find places you need to add coverage, and most likely some where you will be able to save some money.

You might want to think about moving to another state or city to find a cheaper insurance plan. That is because premiums and policies differ by geographical regions. You may be able to save money on auto insurance by moving to another city or state.